| |

The Hamilton Securities Group had a subsidiary charged

with taking our data as it developed on individual

transactions and portfolio strategy assignments

and using it to develop a new approach to investment.

We sought to help investors understand the impact

of their investments on people and places and on

a wider society as a strategy to identify opportunities

to lower risks and enhance investment returns.[83]This

included understanding how to reduce the dependencies

of municipalities and small business and farming

on debt and increase their ability to finance with

equity. Indeed, easy, subsidized access to equity

financing is one of the reasons that large companies

have grown so powerful and taken over so much market

share from small businesses. Access to equity investment

for small business and farms would result in a much

healthier economy and much more broad-based support

for democratic institutions.

We were blessed with an advisory board of very

capable and committed pension fund leaders. In

April 1997, we had an advisory board meeting at

Safeguard Scientifics where the board chair led

a venture capital effort. I gave a presentation

on the extraordinary waste in the federal budget.

As an example, we demonstrated why we estimated

that the prior year’s federal investment

in the Philadelphia, Pennsylvania area had a negative

return on investment. It was, however, possible

to finance places with private equity and then

reengineer the government investment to a positive

return and, as a result, generate significant

capital gains. Hence, it was possible to use U.S.

pension funds to increase retirees’ retirement

security significantly by investing in American

communities, small business and farms — all

in a manner that would reduce debt and improve

skills and job creation. This was important as

one of the chief financial concerns in America

at that time was ensuring that our retirement

plans performed financially to a standard that

would meet the needs of beneficiaries and retirees.

It was also critical to reduce debt and create

new jobs as we continued to move manufacturing

and other employment abroad. If not, we would

be using our workforce’s retirement savings

to finance moving their jobs and their children’s

jobs abroad.

The response from the pension fund investors

was quite positive until the President of the

CalPers pension fund — the largest in the

country — said, “You don’t understand.

It’s too late. They have given up on the

country. They are moving all the money out in

the fall (of 1997). They are moving it to Asia.”

He did not say who “they” were but did

indicate that it was urgent that I see Nick Brady

— as if our data that indicated that there

was hope for the country might make a difference.

I thought at the time that he meant that the pension

funds and other institutional investors would

be shifting a much higher portion of their investment

portfolios to emerging markets. I was naive. He

was referring to something much more significant.

The federal fiscal year starts on October 1st

of each year. Typically the appropriation committees

in the House and Senate vote out their recommendations

during the summer. When they return from vacation

after Labor Day, the various committees reconcile

and a final bill is passed in September. Reconciling

all the various issues is a bit like pushing a

pig through a snake. Finalizing the budget each

fall can make for a tense time. When the new bill

goes into effect, new policies start to emerge

as the money to back them starts to flow. October

1st is always a time of new shifts and beginnings.

In October 1997, the federal fiscal year started.

It was the beginning of at least $4 trillion going

missing from federal government agency accounts

between October 1997 and September 2001. The lion’s

share of the missing money disappeared from the

Department of Defense accounts. HUD also had significant

amounts missing. According to HUD OIG reports,

HUD had “undocumentable adjustments”

of $17 billion in fiscal year 1998, and $59 billion

in 1999. The HUD OIG refused to finalize audited

financial statements in fiscal year 1999, refused

to find out the basis of the undocumentable adjustments

or to get the money back and refused to disclose

the amount of undocumentable adjustments in subsequent

fiscal years.[84]

The HUD OIG continued to invest significant resources

in persecuting Hamilton during this time.

|

|

Courtesy: New Yorker Magazine |

|

|

The contractor who was blamed for the missing

money at HUD was a financial software company

named AMS. My old partner, Steve Fenster, the

Dillon Read banker who led the firms effort in

the Campeau leveraged buyout of the Federated

Department Stores which had gone bankrupt (See

my description expressing my concerns to Steve

regarding this deal in “A Parting of the

Ways” earlier in this story), had been a

board member of AMS until his death in 1995, when

he was replaced by Walker Lewis, a board member

affiliated with Dillon Read and now, as Chairman

of Devon Value Advisors, a consulting partner

to Pug Winokur and Capricorn Holdings. With $17

billion and $59 billion missing from HUD, Secretary

Cuomo never fired AMS or seized their money. Indeed

the AMS Chairman Charles Rossotti was appointed

IRS Commissioner and given a special waiver to

keep his AMS stock. As a result, he profited personally

when HUD kept AMS on its contractor payroll and

new task orders were awarded to AMS by the IRS.

As IRS Commissioner, he oversaw the responsibilities

of the IRS criminal investigation division that

plays a special role with respect to money laundering

enforcement during the period when $4 trillion

went missing from the Federal government. When

Rossotti left government service, he joined Lou

Gerstner at The Carlyle Group.

If we assume that the $17 billion went missing

at HUD during 1998 on an even basis — that

is, $1.4 billion a month, $63.6 million per week

day, $7.9 million per working hour — by the

summer of 1998, approximately $14 billion would

have been missing from HUD alone, not counting

other agencies. Where did it go? Was it financed

with securities fraud using Ginnie Mae or other

mortgage securities fraud or fraudulently issued

U.S. Treasury securities? These are important

questions. Interestingly, this was also a period

in which some of the most powerful firms in Washington,

D.C. or with Washington ties were having remarkably

good luck raising capital. Indeed, the period

of missing money coincided, not surprisingly with

a “pump and dump” of the U.S. stock

market and a significant flow of money into private

investors hands.

| PUMP

and DUMP |

| Adapted

from Wikipedia, the free encyclopedia.

The financial fraud known as

“pump and dump” involves

artificially inflating the price

of a stock or other security

through promotion, in order

to sell at the inflated price.

This practice is illegal under

securities law, yet it is particularly

common.

Read

on ... |

|

|

Let’s look at some examples. Cornell Corrections

was far from the only company to raise funds during

this period and Dillon Read far from the only

investor to cash out. Indeed, in the scheme of

things, Dillon Read’s investment in Cornell

Corrections can be described as a financially

modest in size — albeit highly successful

in percentage terms — venture investment.

For example, Dillon’s investment and profits

look tiny when compared to the billions that KKR

was investing in RJR. Whether large or small,

I would argue that both investments are highly

informative regarding the real corporate business

model prevailing in the US and globally.

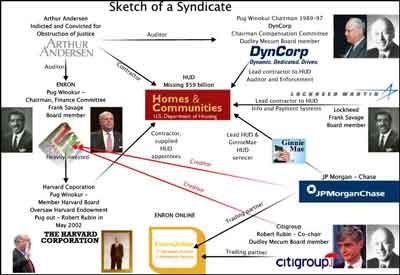

In the summer of 1998, Carlyle Group announced

that it had closed its European Fund with $1.1

billion. By the end of the decade Carlyle had

more than a dozen funds with close to $10 billion

under management. In the meantime Enron, transacting

with Wall Street, was enjoying a rush of good

luck with offshore partnerships and growing revenues

from “the new economy.” Enron’s

leaders included a “Who’s Who”

of government contracting. Pug Winokur was the

chairman of the Enron finance committee. Pug was

also an investor and board member in DynCorp,

who was running critical and highly sensitive

information systems for DOJ, HUD, HUD OIG and

the SEC. Arthur Anderson, Enron & DynCorp’s

auditor, (also Cornell Correction’s auditor)

was a major contractor at HUD. Frank Savage, a

board member of Lockheed Martin, the largest defense

contractor that at the time was paid more than

$150 million a year to run the HUD information

systems, was also on Enron’s board and finance

committee. Enron and HUD shared all the same big

banks — Citibank, JP Morgan-Chase —

and Wall Street firms. Winokur was on the board

and invested with the Harvard endowment, a large

investor in Enron. The attorney representing his

firm on SEC documents, O’Melveny and Myers,

a prominent Los Angeles firm, was reported to

be the lead firm helping Al Gore during the 2000

election. Harvard University was a HUD contractor

and major source of HUD, Treasury and White House

officials. The Harvard Endowment was a major investor

in HUD real estate and mortgage operations along

with Pug Winokur and his investment company. Harvard

employees were one of the largest groups of lifetime

contributors to Bill Clinton. Harvard was also

a source of appointees for OMB, DOJ, SEC, DOD

and other agencies throughout the government.[85]

During the Clinton Administration the Harvard

Endowment rose from approximately $4 billion to

almost $20 billion, an astounding performance.

(Graphics: Sanders Research Group, republished

from Scoop Media)

To repeat a critical point made earlier in our

initial discussion of the leveraged buyout business

that has engineered a takeover of America’s

economy — money is like the Pillsbury Doughboy.

When you squeeze down on one part — it pops

up someplace else. While we do not yet know the

truth of who now has $4 trillion (or some other

very large actual amount of cash and/or fraudulently

issued securities) of undocumentable transactions

indicating extraordinary amounts missing from

the U.S. government or trillions more that disappeared

out of pension funds and retail investors stock

holdings during this period, we do know who has

growing financial resources. We also know the

extent to which extraordinary enforcement resources

were used to target many of the honest people.

SRA's highly recommended `Mr. Global' strip

by Justin Ward and Chris Sanders

On December 18, 1997, the CIA Inspector General

delivered Volume I of their report to the Senate

Select Committee on Intelligence regarding charges

that the CIA was complicit in narcotics trafficking

in South Central Los Angeles. Washington, D.C.

’s response was compatible with attracting

the continued flow of an estimated $500 billion–$1

trillion a year of money laundering into the U.S.

financial system. Federal Reserve Chairman Alan

Greenspan in January 1998 visited Los Angeles

with Congresswoman Maxine Waters — who had

been a vocal critic of the government’s involvement

in narcotics trafficking — with news reports

that he had pledged billions to come to her district.

In February Al Gore announced that Water’s

district in Los Angeles had been awarded Empowerment

Zone status by HUD (under Secretary Cuomo’s

leadership) and made eligible for $300 million

in federal grants and tax benefits. At the same

time, the existence of Hamilton’s software

tools and databases would have posed a significant

risk if my team and I had become aware of the

"Dark Alliance" story. The fastest way

to connect the dots would have been for me and

my teammates to have looked at the maps of high

HUD single family defaults contiguous to areas

of significant narcotics trafficking that we had

posted on the Internet and then use the Hamilton

Securities software tools and databases to dig

deeply into government financial flows in the

same areas, including patterns of potential mortgage

and mortgage securities fraud.

|

|

The Map of South Central

Los Angeles, California

(Map courtesy The Hamilton

Securities Group) |

|

|

The destruction, suppression and theft of our

software tools, databases and computer system

was arranged by a series of events between late

1997 and early 1998 that was so orchestrated throughout

government, media and members of the Council of

Foreign Relations that I would never have believed

it if I had not lived through it.[86]

The Washington Post mysteriously killed

a story about what was happening to The Hamilton

Securities Group at the last minute — just

as they had done with the Mena story in 1995.

Our errors and omission insurance carrier suddenly

refused to pay our attorneys, who withdrew from

representation of The Hamilton Securities Group.

|

Hayes

Farm, purchased by

Catherine's maternal grandparents

on their honeymoon and passed

down through the generations,

has a panoramic view of Mt.

Washington and the Presidential

Range in the White Mountains

of New Hampshire — but

no electricity. (Photos courtesy

Catherine Austin Fitts) |

|

|

I sold my interest in our family farmland to

my uncle to try to get new attorneys to manage

the assault of legal and investigatory workflow

coming our way. The HUD OIG then called my uncle,

apparently trying to persuade him that I was a

criminal, and sent four HUD OIG and FBI agents

to his home in New Hampshire at night with a subpoena.

Their pretext was that they needed to review the

family financial records for the farm to see if

I had been entertaining government employees at

this “vacation resort.” In time they

would come to understand that no government officials

had ever joined me at the farm and that the farm

did not have electricity and depended on an outhouse

for “basic” functions.

Judge Sporkin ruled against us in our efforts

to get HUD to pay us immediately monies owed for

work performed and then, for no legitimate reason,

authorized our digital records and papers to be

seized. On March 8, 1998, a court representative

with a team of HUD OIG and FBI investigators landed

in our offices and took them over. All copies

of all documents whether in our office or in our

homes and personal possessions were turned over.

We were not allowed to keep copies of anything.

We had been ordered by HUD to wipe all HUD databases

from our server — most of which were available

to the public by law — and certify that they

had been wiped clean. We were told we could get

copies or excess items of what had been turned

over back quickly. In fact, with the exception

of one server and a few computers, it took many

years to recover any of our files. By the time

our most critical files were returned to our control,

our most valuable software tools had “disappeared”

while under court control.

We were later to discover that DOJ was using

CACI as a litigation support contractor on our

case. CACI was the leading supplier of Geographic

Information Systems software and services to the

U.S. government who later was in the headlines

as a result of their connections to the prison

at Abu Grahbi in Iraq. This begs the question

whether DOJ was paying our competitor to help

themselves to our proprietary software and databases.

Some time after our entire digital infrastructure

was taken over, DOJ came out with a geographic

information systems mapping tool to help support

increased community policing and enforcement product.

You had to wonder if this was the “Sheriff

of Nottingham’s” answer to Community

Wizard — rather than using software to allow

citizens to understand what government was doing,

why not use software to provide increased surveillance

of citizens by government.

While in possession of our offices, the HUD OIG

investigators took empty shredding bins, filled

them up with trash and then — from a separate

floor — found and added corporate accounting

files and then staged photo-taking by the HUD

IG General Counsel, Judith Hetherton, who then

sent us a letter alleging obstruction of justice

as evidenced by our “throwing out” corporate

accounting records. We were saved by a property

manager who witnessed this charade and decided

to help us out after he saw the intentional —

and very disgusting — trashing of the The

Hamilton Securities Group offices and was touched

by our efforts to clean it up. The property manager

had come to the U.S. from Latin America—presumably

to find freedom from lawless government. One of

our attorneys went into the office when the federal

investigators were there and came out shaking.

He said to me, “My parents left Germany to

get away from these people. Now they are here.

Where do I go?”

Meanwhile, as soon as The Hamilton Securities

Group’s digital and paper records and tools

were under court control, computers auctioned

off and websites taken down, Congress held surprise

hearings on March 16, 1998 on Volume I of the

CIA Inspector General’s Report on Gary Webb’s

"Dark Alliance" allegations about government

involvement in cocaine trafficking. The CIA Inspector

General during these hearings disclosed the existence

of the Memorandum of Understanding between the

CIA and DOJ that had been created in 1982. Sporkin,

the judge who had just engineered the destruction

of Community Wizard and our digital infrastructure

and had the carcass under his control, was the

CIA General Counsel when that MOU was engineered.

There was one small glitch. When we were next

allowed in our offices one evening in mid-March,

we took the main server and brought it back to

my home. The next day, a HUD auditor was stunned

to see it gone — he assumed that everything

would be wiped clean and sold. He asked where

the server was and one of my partners said, “we

took it last night.” At which point the HUD

auditor said, “You can’t do that. My

instructions are you are not allowed to have any

of the knowledge.” He then could not come

up with a rational reason or lawful basis as to

why that was so and why The Hamilton Securities

Group was to be denied access to its own property.

While the private prison companies were booking

more contracts and billions of dollars were going

missing from HUD, I spent the next months slugging

through hundred-hour work weeks managing some

eighteen audits, investigations and inquiries

and twelve different tracks of litigation while

struggling under the drain of significant physical

harassment and surveillance and an ongoing smear

campaign.

Information was dribbling out which ultimately

would provide relief. Congresswoman Waters read

the Memorandum of Understanding between the CIA

and DOJ into the Congressional Record in May.

Then in June, Gary Webb published his book Dark

Alliance. I saw a brief piece pooh-poohing

it in a corporate magazine and realized that somehow

this might help explain the insanity that I was

dealing with and could not understand.

After reading Dark Alliance, I started

to study the extraordinary moneymaking business

that DOJ and agencies like HUD had built in enforcement

that really only made sense if in fact the government

was entirely complicit in narcotics trafficking

and related mortgage and mortgage securities fraud.

I started to realize the extent to which private

information systems and accounting software companies

like DynCorp and AMS were taking control of government

agencies behind the scenes — thus creating

the conditions for billions of dollars to disappear

from government accounts. Then I started to research

private prison companies when a banker from our

bank — whose colleagues' behavior had been

egregious and I believe criminal towards us—told

me how much money they were making in Washington

D.C. gentrification and private prisons. This

was a theme that kept repeating itself during

this period. Private prisons were the next “big

thing” and were going to be “real money

makers.” It was not just Scott Nordheimer

who had tried to persuade us of this. When I had

met with several senior partners of Coopers &

Lybrand in late 1994, they assured me that I should

shift my focus from communities to prisons —

that the future was in enforcement and prisons.

In September, I discovered that DOJ owned a prison

business company, the Federal Prison Industries,

marketed by the name of UniCor. It markets federal

prison labor to federal agencies. It turns out

that Edgewood Technology Services, a Hamilton

Securities Group brainchild and investment, was

a potential competitor with DOJ’s own prison

company for federal data servicing contracts.

UniCor’s website indicated that they had

a growing data servicing business with a focus

on Geographic Information Systems (GIS) software

products — the same as Edgewood Technology

Services. It made me wonder if Scott Nordheimer

had given DOJ and its Federal Bureau of Prisons

our business plan despite my insistence that we

were not interested in prison opportunities. I

called the head of the data-servicing group in

UniCor, who was amazed to hear the story I told

him. He said something to the effect of: “That

makes no sense. Most people end up in prison because

they cannot get good jobs. It is much more expensive

to have them working in prison than not come here

in the first place.” He was eager to meet

with me, as he was interested in helping good

data servicing workers find jobs when they left

prison. I told him to check with his superiors

and that I would love to meet with him. He never

called me back.

| Federal

Prison Industries

The Department of Justice’s profits

from prison labor grew along with the growth

of federal prisoners — the vast majority

of whom were non-violent offenders. An April

12, 2004 story in Government Executive magazine,

Prison labor program under fire by lawmakers,

private industry, by K. Daniel Glover

shows the rise of DOJ’s prison sales

and labor force as more arrests and incarcerations

are good for business.

Federal Prison Industries'

Growth

| Year |

Number of

Factories |

Sales

(Millions) |

FPI Workers |

Total Inmates |

Product Groups |

| 1985 |

71 |

$238.9 |

9,995 |

36,042 |

4 |

| 1990 |

80 |

343.2 |

13,724 |

57,331 |

5 |

| 1995 |

97 |

459.1 |

16,780 |

90,159 |

5 |

| 2000 |

105 |

546.3 |

21,688 |

128,122 |

5 |

| 2001 |

106 |

583.5 |

22,560 |

156,572 |

8 |

| 2002 |

111 |

678.7 |

21,778 |

163,436 |

8 |

| 2003 |

100 |

666.8 |

20,274 |

172,785 |

8 |

Source: Federal Bureau of

Prisons, quoted at http://www.govexec.com/dailyfed/0404/041204nj1.htm

A report from The Center for Public Integrity

in September 2004 reported that the Federal

Prison Industries was the 72nd largest defense

contractor with $1.4 billion of contracts

between 1998-03, describing it as follows:

“Federal Prison Industries,

also known as UNICOR, uses federal prisoners

to manufacture a wide variety of products

including furniture, clothes and electronic

equipment. It also provides administrative

services such as data entry and bulk mailing.

A government-owned corporation, it operates

as a part of the Federal Bureau of Prisons

and is the Defense Department's number

one supplier of clothing, furniture, and

household furnishings.”

|

Then on October 8th, an hour after the House

of Representatives voted to move forward with

the Clinton impeachment hearings, the CIA quietly

posted Volume II of the CIA Inspector General

report on the "Dark Alliance" allegations

on their website. Volume II included a copy of

the Memorandum of Understanding between DOJ and

CIA. The message from President Clinton to the

Republicans was simple and clear. “You take

me down and I will take everyone down.” Literally

the next day, October 9th, Secretary Andrew Cuomo

issued a series of sole source contracts through

Ginnie Mae, the mortgage securities operation

at HUD, to John Ervin’s company (the same

company leading the qui tam lawsuit against Hamilton)

and to Touchstone Financial Group, a firm apparently

started by a former Hamilton Securities Group

employee who brought on a series of former Hamilton

people to do some of the Hamilton work for HUD.

One can only make a list of more unanswered questions

of the political deals that may have been happening

behind the scenes. After all, October 1, 1998

was the beginning of the fiscal year in which

HUD was missing $59 billion from its accounts

— for which the HUD OIG was to refuse to

provide an audit as required by law. This amount

of money translates into $4.9 billion per month,

$1.2 billion per work week or $30.7 million per

work hour. This was somebody’s payback time.

|

| A

FOIA response by HUD indicated

that HUD Secretary Andrew Cuomo

had engineered Ginnie Mae contracts

for Ervin in October 1998 that

could help finance Ervin's lawsuits

against HUD and Hamilton Securities. |

|

|

|

|

|

| |

Ike

Kohn

(Courtesy

Institute of Advanced Studies) |

|

|

|

Disgusted with events in Washington during this

period, I headed to New York to try to get a sense

of what this meant on Wall Street. I went down to

Wall Street to have lunch with Bart Friedman, one

of the partners at Cahill Gordon, Dillon Read’s

lead law firm. Bart was someone I had immense respect

for and who had helped Hamilton with our legal work.

As we were having lunch at a private club near Cahill,

Bart's senior partner, Ike Kohn, walked by. When

I was at Dillon Read, Nick Brady would introduce

Ike as our most trusted attorney. Bart said something

to the effect of, “Ike, you remember Austin

Fitts.” Ike looked at me and sneered with hostility

and walked away abruptly in a manner that was shocking

to me. At least it was shocking until I saw the

SEC filings for Cornell Corrections. Bart Friedman

had handled all of Dillon’s investment and

underwriting files for Cornell Corrections. While

Ike may have been scared that I might connect the

dots at lunch, I did not. I plowed through the SEC

documents for Wackenhut Corrections and Corrections

Corporation of America. I did not look at Cornell

until years later. To this day I wonder what Ike

knew about what happened to The Hamilton Securities

Group.

|

| |

| It's

a Small World: While

Cahill Gordon & Reindel was

helping Dillon Read build Cornell

Corrections, it was also providing

legal counsel to The Hamilton

Securities Group. |

|

|

I then headed to a birthday party for a member

of the family of a Dillon Read partner being held

at the Colony Club, an elegant private club on

Park Avenue. A rush of friends wanted to know

what I thought of prison company stocks. They

were all in them, the brokers were pushing them,

they were the “new hot thing” and they

were anticipating delicious profits. I said get

out, the pricings assumed incorrectly that piling

people into prisons — the innocent and guilty

alike — was like warehousing people in HUD

housing. Sure enough, the stocks were to later

plummet. But not until the Wall Street Journal

ran a story about decorators using prison equipment

to do bathrooms and kitchens on Park Avenue and

Esquire ran a fashion layout in front

of a series of jail cells. To this day, I wonder

how many of the people I spoke to that evening

had bought Cornell Corrections stock from Dillon

Read.

I came back to Washington, D.C. feeling that

the world had indeed gone mad. Everywhere I turned

I saw people who seemed quite happy to make money

doing things that drained and liquidated our permanent

infrastructure and productivity as a people and

a nation. Our financial system had become a complex

mechanism that allowed us to profitably disassociate

from the sources of our cash and concrete reality.

After several conversations with my attorneys,

I realized that the efforts to frame us had failed

and now those involved had been left with a bit

of a mess as we were turning in the court affidavits

that documented intentional falsification and

suppression of evidence. My assessment was that

DOJ would be willing to drop everything if we

simply let them keep all of The Hamilton Securities

Group’s money. Whatever the urgent thrust

had been, it was over. Was it because Dillon had

now cashed out all of their money? Was it because

all of the software tools and databases were effectively

suppressed and would not lead millions of Americans

to connect mortgage fraud with the Dark Alliance

story? Was it because the covert cash spigot had

been turned on and $59 billion was pouring out

of HUD to feed the hungry beast the appetizer

followed by a main course of $3.3 trillion missing

from the Pentagon? Was it because, with honest

people forced out and the bureaucracy properly

terrorized, the housing bubble was now being fueled

with explosive federal credit from FHA, Ginnie

Mae, Fannie Mae and Freddie Mac? Or was it a combination?

More than anything, there had been a very intense

and personal desire to see me in prison. It had

failed. I made a decision that I was not going

to simply walk away. I was going to get to the

bottom of what happened.

What communities in America and worldwide most

need is the truth. We need the ability to know

whom we can trust and who we cannot trust. We

need to know how to build a life, a family, a

small company, and retirement savings and be able

to protect them from corruption. We need to generate

an income that builds up our wealth and equity,

rather than a subsidy that keeps us going while

our equity slowly drains out of our savings and

our communities. Any successful explorer will

tell you that all the resources in the world are

of little use if you have a bad map and as a result

end up naked to the elements.

|

| |

Catherine's

Home, Fraser Stables,

a converted carriage house and

stables in downtown Washington,

D.C. was sold to help defray

the expenses of litigation and

escape ongoing physical harassment

and surveillance. (Photos courtesy

Catherine Austin Fitts) |

|

|

The first step was to understand organized crime

— a topic that I had never been interested

in. I called an organization that sold tapes by

researchers on government corruption and narcotics

trafficking and bought the tapes he recommended.

So began a journey of reading and watching thousands

of books and videos and networking with researchers

globally.

Later that year, I published an article about

the potential connection between the Dark

Alliance allegations and the efforts to suppress

our transparency tools and what that may imply

regarding the possible use of HUD mortgages and

mortgage fraud by these same networks. Right after

the article was published on May 22, 1999 with

copies delivered to the Intelligence Committee

subscribers, Congress suddenly held closed hearings

on Volume II of the CIA Inspector General’s

reports, taking testimony in secret from DOJ Inspector

General Michael Bromwich and CIA Inspector General

Britt Snider.[87]

It was clear where things were going by that

summer. In June of 1999, Richard Grasso, Chairman

of the New York stock exchange, went to Colombia

to visit a Revolutionary Armed Forces of Colombia

(FARC) Commander to encourage him to reinvest

in the U.S. financial system. At the time of his

visit, the General Accounting Office reported

on FARC’s growing influence in the Colombian

cocaine market.[88]

|

| Richard Grasso

hugging a FARC Commander in 1999

in a rebel village in Colombia at

the time the GAO reported that FARC

had assumed control of a majority

market share of the Colombian cocaine

trade. (Photo courtesy

LaRouche Campaign) |

|

As I learned more about the black budget and covert

cash flows at work in our economy, I also learned

more about their history. I began to connect more

of the dots to my personal history and that of

my family, friends and neighbors. I realized that

the viciousness of the current attack could relate

not just to my work at Hamilton but to problems

that my family had dealing with similar, if not

the same, people long ago. [88.5]

It only served to reinforce the wisdom of my decision

to pursue the litigation and get to the bottom

of what was happening and why. In the famous words

of George Santayana, "those who do not learn

from history are doomed to repeat it." I

was to spend many years resolving the litigation

and building new networks that I needed to found

and grow my investment advisory company —

helping to preserve and grow family wealth in

a world increasingly defined by financial and

political corruption.

|

|